Retail and HNI investors have emerged as big buyers in the last 18 months. Considering the US economic data and Fed action going ahead, do you think the FII flow will continue in the rest of financial year 2021-22?įlows continue to be strong from both local as well as global investors. Q: After dovish Fed commentary, foreign investors returned to India last week. The key near term risk is that of any third Covid wave. The markets are fundamentally supported as long as corporate profitability is on the upswing. Stock Price is the slave of earning power.

Tax cuts, tighter working capital, reduction in debt and interest burden, cost control etc., have pushed corporate profitability higher. Talking about fundamentals, we are likely witnessing the beginning of a new multi-year profit cycle.

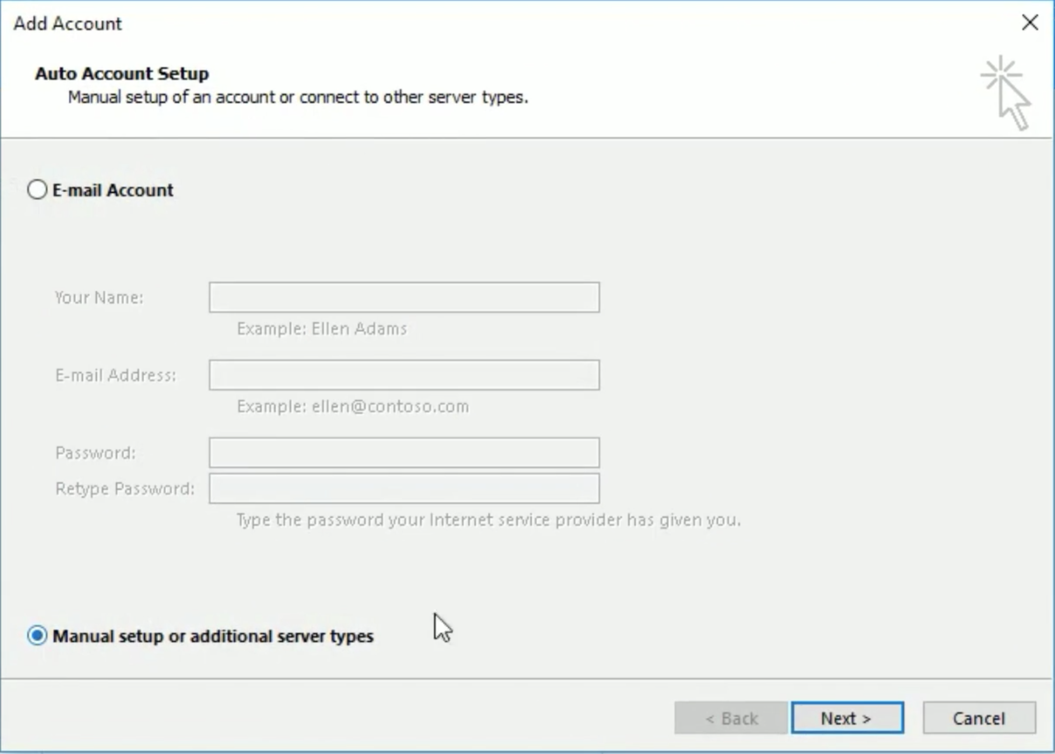

#Use zoho outlook amc drivers#

Our view remains that while in the near term headline valuations are at the upper end of the trading band, the drivers of the market in terms of corporate profitability, sentiment and valuations remain well placed from a medium to long term perspective. Those who took the pain in March 2020 have seen the markets move up sharply post that. However, what is needed for long term wealth creation is discipline and patience. Volatility is part and parcel of equity markets. We believe that time in the market is more important than timing the market. Q: Is it the time to turn cautious and book profits or remain invested in the market considering 10 percent returns from August? However, if one looks at a medium to long term perspective, we find ample opportunities in the market to create long term value for the investors. The market is building in some optimism to this effect and the valuations look on the expensive side. This is helping cap mortality rate and keeping the pressure off the healthcare infrastructure. Around 12 percent of the population is now fully vaccinated and the percentage of population in the large cities who have received at least one dose is high. On an average vaccinations per day basis, the trend of improvement has continued in September 2021 as well. Importantly, the pace of vaccinations has improved over the last month (around 10 million+ doses each on 2 days was seen).

In India, new Covid cases remained largely under control (30,000-40,000 daily). Sentiment has also been boosted with the Covid case trajectory and the improvement in the number of vaccines administered. Together with the reforms and government push to accelerate economy we expect the corporate profits to keep on growing for the next few years. The pent-up demand, shift from unorganised to organised sector and cost optimisation has all lead to better profits for the listed space. The earnings trajectory for corporate India has seen a sharp move up in the recent quarters and we expect that corporate earnings growth is likely to remain healthy in FY22.

#Use zoho outlook amc driver#

We believe that the key driver for the market are threefold: a) fundamentals b) sentiment and 3) flows.

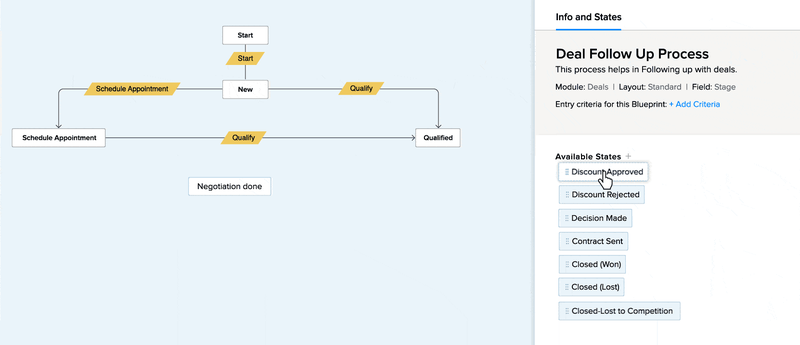

#Use zoho outlook amc series#

0 kommentar(er)

0 kommentar(er)